SWA Online, a leading business portal, have released a report on the investment habits of Indonesians since the pandemic, which they say, has been one of the driving forces creating awareness among Indonesians of the importance of having financial planning, including emergency funds, health insurance, and investments.

SWA report that Populix recently conducted a survey to review the awareness and behaviour of Indonesians in investing, as well as their investment plans in the future.

The survey report entitled “Insights and Future Trends of Investment in Indonesia” shows that the Indonesian people have a better awareness of investing. The majority (72-percent) of respondents surveyed said that they had started investing, especially among the millennial generation.

This figure has increased when compared to the Populix survey in January 2021, where it was recorded that less than half of the respondents (44-percent) had started investing.

Dr. Timothy Astandu, Co-founder and CEO of Populix, explained the survey shows that more and more Indonesian people, especially the younger generation, are literate about investment. The presence of various investment applications in the country certainly encourages inclusivity for young people to start investing, as can be seen from the majority of respondents who choose to invest through applications, say SWA.

In addition, before deciding to invest, the respondents had considered aspects of their financial condition, the clarity of information and the risk profile of each investment instrument. This means that now they have better financial awareness and literacy before starting to invest. Of course, this is a positive point for Indonesia. However, this phenomenon also serves as a reminder that collaboration is needed between various parties to continue to balance the interest of young Indonesians in investment trends with even better financial literacy,” he explained in a written statement in Jakarta (1/12/2022).

The majority of respondents (64-percent) of all ages have the main goal of investing to collect emergency funds. In particular, when looking at the investment behaviour of each generation, the survey shows that apart from collecting emergency funds, Gen Z and Millennials tend to invest to earn additional income, while Gen X has a goal of collecting retirement funds, report SWA.

Mutual funds (47-percent) are still the most preferred investment instrument by Indonesians since 2021. Apart from that, other investment instruments that are currently also widely chosen include gold jewelry (46-percent), stocks (32-percent), precious metals (30-percent), deposits (29-percent), property (21-percent), to crypto (20-percent).

Investment instruments that are registered with the Financial Services Authority (OJK) and have a low risk profile are the two main reasons for respondents choosing the intended investment instrument.

To find information about investment instruments, the majority (68-percent) of Indonesians use social media, particularly YouTube and Instagram. In addition, they also seek official information from OJK (42-percent), friends or colleagues (40-percent), official websites of financial institutions (34-percent), and influencers (32-percent.)

Sources Of Funds And Investment Platforms For The People Of Indonesia

In investing, 5 out of 10 respondents said they set aside some funds from their regular income and savings. Among the 54-percent of respondents who allocate their budget from regular income, the majority set aside around IDR 100,000 to IDR 250,000 of their income.

On the other hand, respondents also allocate 5 to 10 percent for investment funding sources from other income, such as savings, bonuses or additional income, THR, funds from family, emergency funds, and proceeds from selling assets.

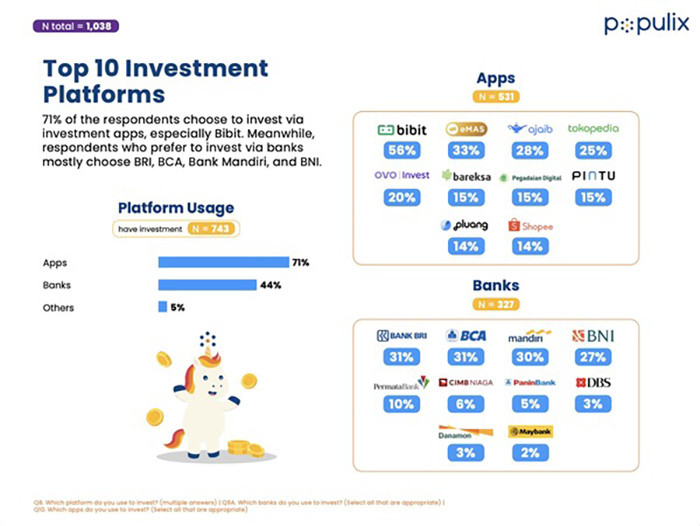

Respondents tend to invest through application platforms, banks, or even both. 71-percent of respondents chose to invest through an application because of the convenience in one application, investment conditions that are not complicated, and only require relatively small capital.

Seeds (56-percent) is the investment application used by half of the respondents, followed by DanaEmas (33-percent), Ajaib (28-percent), Tokopedia (25-percent), and Ovo Invest (20-percent.)

On the other hand, 44-perecnt of respondents who chose to invest through banks said that they considered banks to be trusted companies for investment purposes, ease of investment, and have uncomplicated conditions.

Some of the main banks trusted by respondents to invest include BRI (31-percent), BCA (31-percent), Bank Mandiri (30-percent), and BNI (27-percent.)

Amid the increasing interest of the Indonesian people in investing, there are still 28-percent of respondents who have not yet invested due to insufficient financial conditions to start investing.

In addition, there is also an understanding that investment requires large amounts of funds (36-percent), are afraid to take risks (32-percent), have difficulty understanding information about investments (20-percent), experience trauma from investment fraud in the past (14-percent), and contrary to belief or at risk of containing usury (8-percent.)

However, 95-percent of respondents already have plans to invest in the future, especially in precious metal instruments (49-percent), gold jewelry (42-percent), stocks (42-percent), property (37-percent), mutual funds (35-percent), and deposits (32-percent.)

Source: SWA.Co.Id, Editor: Eva Martha Rahayu